Cboe Experiences Another Decline in FX Volume in August

The Chicago Board Options Exchange, also known as Cboe, has reported a new decline in the volumes in the Foreign Exchange market in August, according to data revealed by the company.

In August, the Cboe reported a total trading volume in the Forex market of 602 billion dollars, lower than the levels experienced in July, and considerably less than the record in March when the FX volume in Cboe was of 1,209.6 billion dollars.

The decline in volume follows a peak of trading during the COVID-19 pandemic, and experts see it as a healthy correction.

According to Arnab Shome, an analyst at Finance Magnates, the Forex market is still healthy and trading is inside of an uptrend.

Shome said:

It is to be noted that the institutional trading volume on the US-based exchange was on a steady rising since December last year until the drop from the spike in March, though the market corrected itself drastically, a stable trend is yet to be seen.

As a sample for this, the second quarter saw a volume of 2.06 trillion dollars, a decline from the 2.77 trillion dollars in the first quarter.

On the other hand, Cboe reported that Mini VIX futures daily volume surpasses the 100 thousand contracts for the first time.

According to CBOE:

Daily trading in the firm's newly launched Mini Cboe Volatility Index (Mini VIX) futures surpassed the 100,000-contract mark for the first time, when daily volume reached 117,814 contracts on Thursday, August 27.

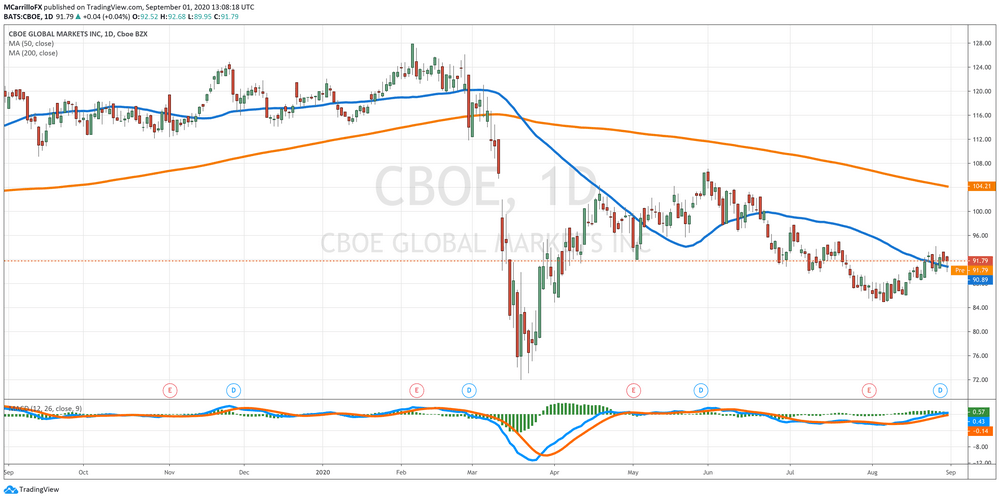

CBOE Shares Analysis

Shares of CBOE are trading negatively and are attempting to reverse on Tuesday the losses performed on the last two sessions.

After recovering from the 84.80 area on August 6, the unit started a steady recovery path that drove the CBOE share to test highs since July 21 at 94.27 on August 26.

However, the unit started, then, a period of consolidation that has kept CBOE between 90.00 and 93.30.

According to TheStreet Quant Ratings, CBOE Global markets Inc is a stock to "hold." The firm considers that revenue growth is good, but the profit margin is not sound.

The Street says:

The revenue growth greatly exceeded the subsector average of 3.8%. Since the same quarter one year prior, revenues rose by 40.0%. Growth in the company's revenue appears to have helped boost the earnings per share.

However:

The gross profit margin for CBOE GLOBAL MARKETS INC is currently lower than what is desirable, coming in at 34.18%. It has decreased significantly from the same period last year. Along with this, the net profit margin of 13.07% trails that of the sub sector average.

Mauricio is a newer member of the team and a very welcome addition. He is a financial journalist and trader with over ten years of experience in stocks, Forex, commodities, and cryptocurrencies. This experience means he has an excellent understanding of the markets and current events.

News Home

News Home

Privacy Policy

Privacy Policy

About Us

About Us