Warren Buffett Sells All Airlines Stocks Due to COVID-19 Crisis

The Oracle of Omaha reported that Berkshire Hathaway had sold its entire $4-billion stake in airlines as "the world has changed for the airlines." With over 95% travels down in 2020, the company doesn't know "how it's changed" in the middle and long term.

"I don't know that three, four years from now, people will fly as many passenger miles as they did last year," Warren Buffett said in his press conference held at the weekend.

On May 2, Warren Buffett and the entire Berkshire Hathaway investing ecosystem held the 2020 version of their annual shareholder meeting, also known as the "Woodstock for Capitalists." This time, however, it was hosted virtually for the first time ever due to the Coronavirus pandemic.

The legendary investor highlighted that it is very complicated to understand how airlines will evolve from the current situation, especially with the lack of information. He expects the impact to take several years to recover from as the pandemic has an "extraordinarily wide" range of possible outcomes while companies have "too many planes."

As a matter of context, Warren Buffett and Berkshire Hathaway's bet on airlines included a 10% stake in American, 9.2% stake in Delta, 10.1% in Southwest, and 7.6% in United Airlines.

Buffett said he admires the airlines, but there are times that it is better to take a step aside. So, why did Berkshire Hathaway sell its entire US airline position? In Buffett's words:

When we sell something, very often it's going to be our entire stake: We don't trim positions.

Buffett added:

If we like a business, we're going to buy as much of it as we can and keep it as long as we can, and when we change our mind we don't take half measures.

Buffett Has Not Found Anything Attractive to Invest

Berkshire Hathaway has not opened or made any "elephant-sized acquisition" or investment in several years. After its recent closings, the fund has piled up over $137 billion cash by the end of March.

The reason now is pretty evident as Berkshire doesn't like what it sees in the current COVID market situation - the company didn't make any big purchases in recent stock sell-offs - but the behavior comes from many years from now.

"We have not done anything because we haven't seen anything that attractive," Buffett said in the Q&A section of his press conference. Obviously, the Oracle of Omaha is in wait-and-see mode.

Buffet Recommendations

"You probably know that I don't make stock recommendations," Buffett states in Berkshire Hathaway's old-fashioned website. However, he made a simple comment about that Saturday: Buy an index fund.

Buffett said that in his view, the best thing people can do in current times is owning the S&P500 index fund. He also added that usually, people pay much money for advice they really do not need.

If you bet on America and sustain that position for decades, you'd do far better than buying Treasury securities, or far better than following people who tell you what to invest.

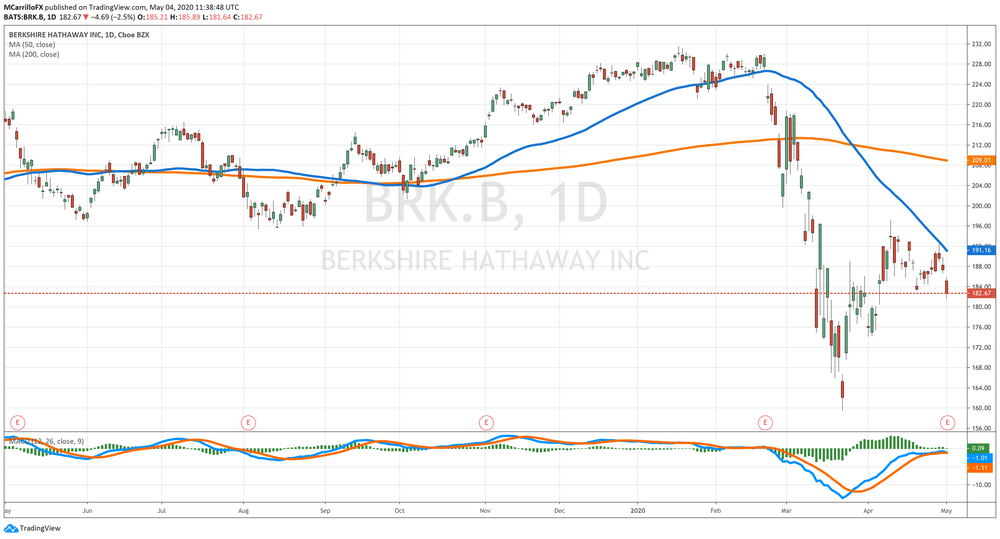

Berkshire Hathaway Shares Analysis

The class B of Berkshire Hathaway shares are expected to trade lower on Monday as the unit is extending its rejection from the 192.70 area touched on April 29. Currently, BRK.B is trading at $180.20, which is 1.35% down on Monday.

BRK.A is losing around $3,025 per share on Monday as the unit falls 1.10% on the day to price below the $271,000 level for the first time in a month. BRK.B is trading around 19.0% down Year to day, while BRK.A is similar to 19.6% negative in 2020.

The trends for both units are pointing to the south with BRK.B having $180.00 as critical support. Below, you will see $177.60 and 176.50 as essential zones of buying.

Ford Equity Research has Berkshire Hathaway as an investing rating qualification of 3 out of 5. Analysts point out that earning strength is positive, relative valuation is neutral, and price movement is still positive.

Ford Equity said:

We project that BRK.B will perform in line with the market over the next 6 to 12 months. This projection is based on our analysis of three key factors that influence common stock performance: earnings strength, relative valuation, and recent price movement.

Mauricio is a newer member of the team and a very welcome addition. He is a financial journalist and trader with over ten years of experience in stocks, Forex, commodities, and cryptocurrencies. This experience means he has an excellent understanding of the markets and current events.

News Home

News Home

Privacy Policy

Privacy Policy

About Us

About Us