SoftBank Will Not Honor $3B Tender Offer For WeWork Shares

Japanese multinational conglomerate SoftBank Group announced the termination of its $3 billion tender offer for WeWork shares agreed last year. According to a press release published by the company, conditions for the deal were not satisfied.

Under the terms of the agreement for the share buyback deal reached in 2019, WeWork founder Adam Neumann was entitled to receive around $1 billion for his shares. Neumann would also get $500 million in credit to repay a loan facility and $185 million in consulting fees.

However, SoftBank would have been reconsidering its position starting this year, citing several regulatory investigations of the office-sharing company that would give it an exit under the deal as WSJ reported last month.

Rob Townsend, Senior Vice President and Chief Legal Officer of SoftBank, said that SoftBank remains committed to the success of the real estate and office-sharing startup. He highlighted the significant steps to strengthen the company since October and the development of a new strategic plan for WeWork.

Townsend also commented that the tender offer to buy shares directly from other major stockholders was conditioned on the satisfaction of certain conditions. Terms that haven't been met, leaving SoftBank no choice but to terminate the tender offer.

Given our fiduciary duty to our shareholders, it would be irresponsible of SoftBank to ignore the fact that the conditions were not satisfied and to nevertheless consummate the tender offer.

SoftBank Says Conditions Were Not Met, so The Deal is Broken

Deal's conditions that have not met and moved SoftBank to take the decision include:

- Failure of signing and closing the roll up of the China joint venture by April 1, 2020

- The inability to obtain necessary antitrust approvals by April 1, 2020

- Failure of closing the roll up of the Asia (ex-China and ex-Japan) joint venture by April 1, 2020

- The opening of multiple, new, and significant pending criminal and civil investigations that have begun since the MTA was signed in October 2019

- Existence of numerous new actions by governments around the world related to COVID-19, imposing restrictions against WeWork and its operations.

On the other hand, SoftBank clarifies that the termination of the tender offer has no impact on WeWork operations, employees, and customers. The five year plan remains in place as well as the expansion of its footprint and transformation into an end-to-end business solutions platform.

Finally, according to a report from Reuters, WeWork board says they were disappointed by the decision, and they are considering all legal options, including litigation.

WeWork Sells Meetup

This week, WeWork announced the selling of its social network Meetup to AlleyCorp and other investors for an undisclosed amount, however, several sources cited by Fortune, confirmed that it was for a fraction of the $156 million that WeWork paid for Meetup acquisition in 2017.

SoftBank Shares Trade Positive After WeWork Decision

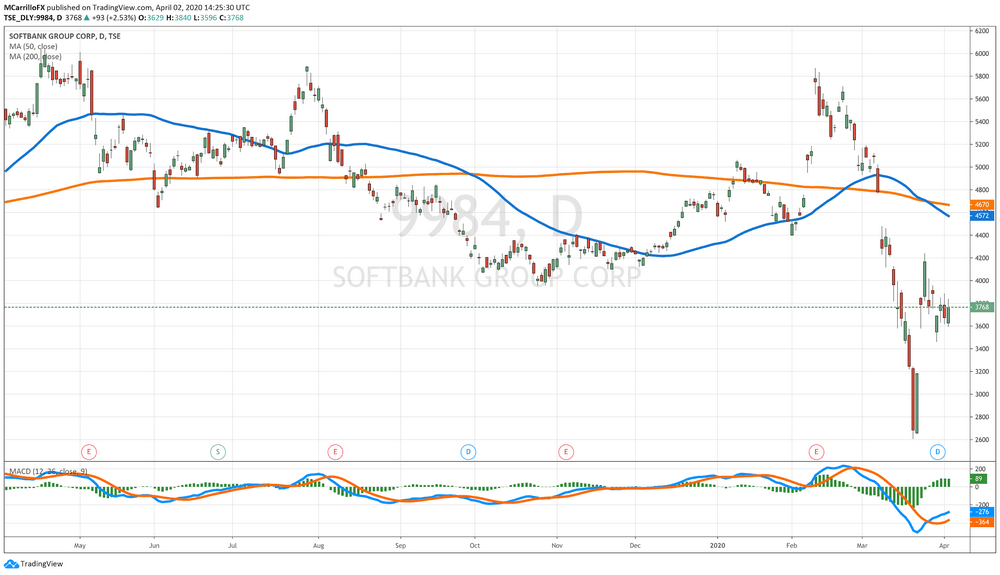

9984 Softbank shares - daily chart on April 2 - Last year

Shares of SoftBank are trading positive on Thursday after the company announced its decision for the termination of its tender offer in WeWork.

SFTBY is trading at $17.23 per share on Wall Street, which is a 3.80% positive in the day. The original 9984 in Tokyo moved at ¥3768 on Thursday, 2.53% positive on the day. The unit closed positive after finding support at the ¥3600 level.

The chart is dovish in the long term due to the coronavirus impact in the Japanese and global economies. However, the market seems to have received the decision about WeWork positively.

Mauricio is a newer member of the team and a very welcome addition. He is a financial journalist and trader with over ten years of experience in stocks, Forex, commodities, and cryptocurrencies. This experience means he has an excellent understanding of the markets and current events.

News Home

News Home

Privacy Policy

Privacy Policy

About Us

About Us