Gold Trades Sideways Ahead of ECB; Long Term Bullish

Gold is trading sideways on Wednesday as investors are weighting the recent sell-off in global stocks, concern on rising COVID-19 cases, and the US Dollar recovery performed in the last days.

It looks like the odds have changed for the US dollar, and it is influencing gold prices as well as other assets such as euro, oil, and stocks.

Following recent not-that-bad economic data in the United States, investors started to consider the US economy's real shape. But what does that mean? Well, an economy in a better form would mean less economic stimulus, which is directly proportional to the money injected to the economy and the stock market.

In that framework, fewer dollars injected into the economy means that the USD's value wouldn't get diluted, and it will represent a stronger dollar. Besides, with an economy in better shape than expected, the interest rate would go higher faster than expected, which is favorable to the USD.

On the other hand, the ECB is now considering more stimulus and France already announced a 100 billion euros package to support the economy. It means more euros injected into the European economy and a weaker EUR.

Besides, fundamental news like the rising concerns about a messy Brexit, the heavy losses in Wall Street, and a euro profit taking move ahead of the European Central Bank's decision on monetary policy on Thursday fuel the USD up.

Gold is Still The Boss

On Wednesday, the dollar index jumped to nearly one-month highs around 93.65. However, with a rebound in stocks, the DXY came under pressure, and it is now negative for the first time in seven days. DXY is now reporting 0.13 percent declines at 93.28. Still .3 percent positive in September.

A stronger dollar would push gold prices down, but as far as global fundamentals are not good - Remember, US data is not good, just not as bad as it was expected - gold is still the safest investment in the market. It is keeping prices in a relatively stable range.

Afshin Nabavi senior vice president at precious metals trader MKS SA, in a note to Reuters said:

It is a combination of investors quitting to fund margin calls and a stronger dollar. However, we don't see a drastic fall in gold because the fundamentals are still rock solid.

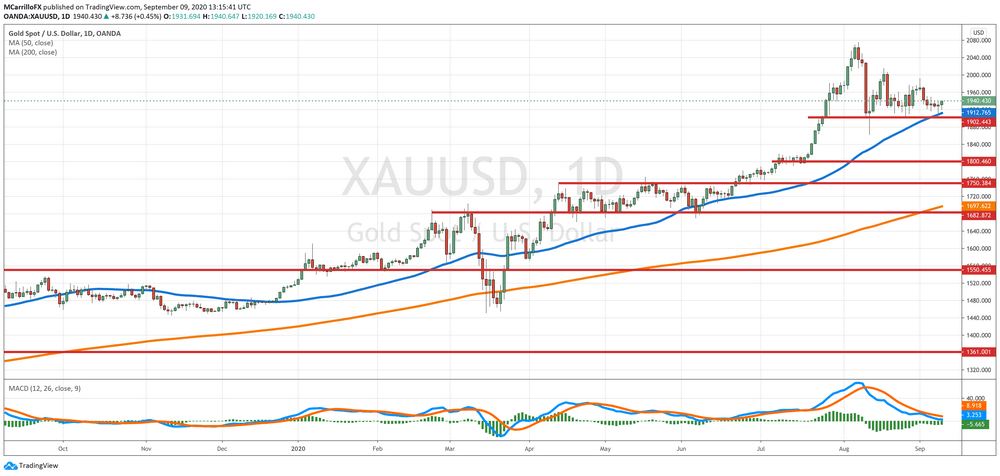

XAU/USD Trades on Sideways Above 1.920

A stronger US dollar is hurting demand for dollar-denominated gold, which is containing XAU/USD upside. However, for most experts, the gold forecast is essentially bullish. Even banks as Bank of America expects gold to jump to 3,000 in one year.

According to Commerzbank analysts, further losses in the stock markets can push gold prices to new highs.

The analysts said:

[Tuesday's] movement of the gold price makes it clear that price falls still generate buying interest among ETF investors rather than prompting selling, the gold ETFs tracked by Bloomberg registered inflows of 3.5 tons yesterday. This was the tenth consecutive day of inflows, even if they are no longer on the same scale as in July.

In the same line, George Gero, managing director at RBC Wealth Management, said in a note to clients that the European Central Bank is expected to try to push down the euro in its policy meeting this Thursday. "Meanwhile, growing economic uncertainty over Britain's plan to leave the European Union is dragging down the British pound."

GERO said in the note:

Look for buyers on larger dips to begin adding expectations of $30.00 silver and $2,000 gold.

Currently, XAU/USD is trading at 1.937, which is 0.29 percent positive on the day. Still inside the small range performed since September 3, between 1.920 and 1.940.

Mauricio is a newer member of the team and a very welcome addition. He is a financial journalist and trader with over ten years of experience in stocks, Forex, commodities, and cryptocurrencies. This experience means he has an excellent understanding of the markets and current events.

News Home

News Home

Privacy Policy

Privacy Policy

About Us

About Us