ETX Capital Review

Editors Summary

When you arrive on this site, you will find it easy to navigate and comprehensive when it comes to opening an account. To familiarise yourself with trading, you have the benefit of being able to open a demo account before you trade with a live version. The educational tools will also help you to enhance your trading skills. There are plenty of currency pairs to choose from, and the spreads are competitive, making it a good contender in the world of Forex brokers.

Risk Warning: The products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad Disclosure: Some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Introduction

ETX Capital garnered its name from the acronym of exactly what they offer – Electronic trading, Telephone trading and eXecution. The company was initially established in 1965 in London, UK, specialising in mortgage bonds. They later introduced stocks and derivatives as TradIndex which later became ETX Capital.

After their early success in London, the company went on to operate in other countries across Europe, Asia and Russia. They are licensed and regulated by the FCA (Financial Conduct Authority) and listed on the London Stock Exchange. With a strong team of developers working alongside professional traders and analysts, they strive to offer a great trading experience.

In the busy world of CFDs, sometimes choosing a broker can be a hard task. There are many criteria to consider to ensure that you get the best from your experience online. To assist you with your choice, we have carried out a full and comprehensive review of ETX Capital and what they provide you, the trader.

Account Types

The first thing that you will notice is that you are invited to open a live account or a demo account. Many brokers offer a demo account to allow traders to try before they buy. It is the live account that requires a deposit. In the first instance, you must enter some necessary information about yourself before progressing to the next stage of opening your account.

Demo Account

A demo account is a perfect choice for new traders, whether you are new to the world of CFD trading or just new to this particular broker. This 'practise' account type allows you to get familiar with the site either on desktop or mobile and to learn about the various features. You can get to grips with the software, place some test trades and get a feel for the site in general. The demo account is available on the MT4 trading platform.

Standard Account

With a deposit of £100, you can open the Standard live account with ETX Capital. This account allows you to place trades on the live platform, regardless of experience, knowledge or size of the trade. Everyone has the same range of features and access to the same trading tools, whether you are spending hundreds or thousands of dollars.

Pro Account

A Professional account is for the more 'Pro' trader. To meet the requirements, you need to meet two out of three criteria. The first is to have over €500k worth of assets which includes your house if you own it. The other two are that you must have relevant experience in financial services and have traded at least ten times in the last four quarters. In return for being a Pro trader with ETX Capital, you will benefit from some additional perks.

Trade Features And Payouts

There are some standard trading features that you will need to examine when choosing your CFD broker. Commonly these are leverage, stop-loss orders and the type of platform. To determine the types of payouts, you can expect you need to take a look at the spreads on offer.

Leverage

When it comes to leverage, the most common across the board tends to extend to 1:30 and this is no different with this particular broker. 1:30 leverage applies to the Standard account; however, professional traders can contact ETX Capital and request better terms up to a limit of 1:300.

Spreads

For the most popular assets, you can expect spreads starting from 0.6 pips. In this case, the popular assets tend to be gold and oil and the other key market commodities.

Stop Loss

Stop, guaranteed stop and trailing stop orders, are all available types of stop-loss orders that you can expect when trading with ETX Capital. The basic stop orders allow you to minimise losses. The trailing stop order means that while you can protect yourself from losses, you don't risk losing out on a potential profit.

Platform Types

You can expect two types of platform and trading software with ETX Capital. First, and more commonly used, is the MetaTrader 4 platform which is free to download and tailored to work with the ETX interface. Then there is their proprietary software; Trader Pro, which is for more experienced and Pro traders. If you are new to CFD trading, the MetaTrader 4 will be the perfect choice for you.

Bonuses And Promotions

Regulation by the FCA prevents brokers from soliciting business via promotions in specific countries. You won't find welcome or no deposit bonuses, particularly in Europe.

There is no mention of any bonuses on the website; however, it is worth noting that they do run bonuses and offer incentives to encourage loyalty.

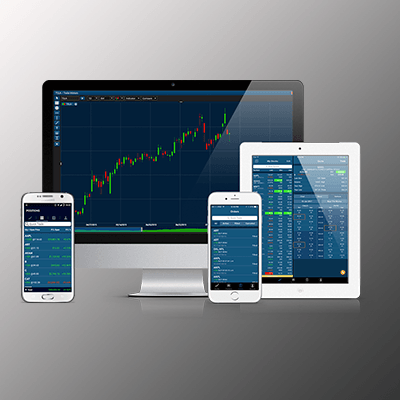

Mobile Trading

It is highly likely that you will want to be able to trade on the move. With ETX Capital, using the MetaTrader 4 software, you can do precisely that. You can choose to use the mobile-friendly version of the site in your browser or download the ETX Capital app. With the app, you have access to charts which you can customize to suit how you trade, and you can monitor your positions and trade on the go.

Both the mobile site and app are intuitive and have everything you need to fulfil your mobile trading requirements. With iOS, you can download the app either for your mobile phone or for a tablet or the compatible Android version. There are so many benefits to the app, including the fact that you can view your portfolio, balances and your open profits and loss, quickly and efficiently. You can open and close trades and set limits and place orders.

When it comes to safety, their long-established record makes them a viable choice.

Deposits And Withdrawals

When you deposit with this broker, you can choose between three base currencies – the Euro, US Dollar or the GBP. With this facility, you are more likely to avoid currency conversion fees.

Deposits are accepted by credit and debit card in addition to bank transfers and electronic wallets like Skrill or Neteller. There are no fees for either depositing funds or making a withdrawal. Withdrawals take up to three business days (in many cases two days) with funds returned to the source of deposit.

Special Features

One of the features of this site is that it offers several order types including market, limit, stop, stop trailing and OCO with various time limits as well. Receive price alerts via push notification to your mobile or via email.

There are many educational tools as well to enhance your trading experience. The fact that there is a free demo account means you can brush up on your skills before you trade with this particular broker.

Customer Support

Unlike many brokers, with ETX Capital, there is no live chat function, and the customer support is not available 24/7. That said, what customer support they do offer is very prompt and relevant. You can contact a representative via phone or email.

You can expect to be connected within a minute in most cases and find them to offer relevant and helpful advice. They are also very professional and courteous. Customer support is available between GMT+1 on Sunday 9.30 pm until Friday at 10 pm.

We want to help our readers in any way we can, but sometimes it's better to talk directly with your investing site to get the answers you need. For example if you have a specific query about your account you'll need to contact them in person due to security.

Alternatively, if you find that contacting your investing partner isn't working, you can contact us and we will be more than happy to try on your behalf. We have excellent working relationships with many of the sites we list and recommend.

ETX Capital

-

Email:

[email protected]

Email:

[email protected]

-

Phone:

+44 020 7392 1494

Phone:

+44 020 7392 1494

-

Address:

1 Broadgate Circle, London, EC2M 2QS, UK

Address:

1 Broadgate Circle, London, EC2M 2QS, UK

Conclusion

When you arrive on this site, you will find it easy to navigate and comprehensive when it comes to opening an account. To familiarise yourself with trading, you have the benefit of being able to open a demo account before you trade with a live version. The educational tools will also help you to enhance your trading skills. There are plenty of market assets to choose from, and the spreads are competitive, making it a good contender in the world of CFD brokers.

When it comes to safety, their long-established record makes them a viable choice. ETX Capital is licensed and regulated by the FCA, which means they have to follow strict guidelines. Being listed on the London Stock Exchange is another reason to find them a reliable broker. If you have any issues or questions, you can be secure in the knowledge that the customer support team are easy to reach. They will be quick to deal with any questions you might have. All in all, this broker ticks lots of boxes when it comes to a straightforward and successful CFD trading experience.

Frequently Asked Questions

-

Is ETX Capital legit? Will they scam me?

-

As a well-established broker listed on the London Stock Exchange and licensed by the FCA (Financial Conduct Authority) means you can be confident your money is safe.

-

Do they have a decent mobile or tablet app?

-

In addition to being able to use the site on a mobile browser, you can also download an app for iOS and Android and trade on the MetaTrader 4 version of the trading platform.

-

What bonus do they offer for new traders?

-

From time to time, there are promotions available, but currently, there are no special promotions offered to encourage you to open a new account with them.

-

Can I start trading on a free demo account?

-

There is a free demo account which is easily accessible and will allow you to practise trading. Use the MetaTrader 4 version of the ETX trading platform while you familiarise yourself.

-

What's the min deposit and ideal trade amount?

-

The minimum deposit amount is £100, €100 or $100, and you can deposit funds in all three base currencies. The minimum trade amount is just £1, $1, €1.

Top Rated CFD Site

#1 - Pocket Option: Best Overall

Risk Warning: The products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad Disclosure: Some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Charles has worked at brokers since he finished his studies at university. Starting as a Junior Trading assistant and progressing into a Business Development we’re delighted that he’s been part of the team since 2015.

Website Reviews

Website Reviews

Mobile Apps

Mobile Apps

Trading Robots

Trading Robots