Plus500 Review

Editors Summary

If you want a broker that you can trust then the fact that Plus500 is so heavily regulated by the world's most recognised regulatory bodies and listed on the LSE should instil confidence. Trading is accessible from a variety of devices making trading on the move as convenient as trading from a desktop. The spreads are competitive, and the overall user experience is intuitive. If you want to trade in over 50 currency pairs, then we think this broker is a good choice.

Risk Warning: The products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad Disclosure: Some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Introduction

Established in 2008 in Israel, Plus500 offers CFD trading in several countries around the world. They are regulated by the top regulatory bodies in the industry, including the FCA (Financial Conduct Authority), CySEC (Cyprus Securities and Exchange Commission) and ASIC (Australia Securities and Investments Commission). They are also regulated in Singapore, New Zealand and South Africa.

Since its inception in 2008, the company has evolved and now offers trading in over 2000 securities and asset classes. In addition to their Israel HQ, they also have offices across the globe and are a public trading company trading under the ticker PLUS on the London Stock Exchange. With a site that is available in 36 languages, they offer several trading platform applications.

While heavily regulated and with no reason to doubt this well-reputed broker, it can be tough to decide if they are the right CFD broker for your specific trading experience. That is where we come in. With our team's extensive knowledge of the CFD markets, we have the expertise to be able to offer you a detailed overview of this broker.

Account Types

When you open an account with Plus500, you have just one choice of account. Instead of choosing from a variety of tiered accounts, each offering additional perks the more you deposit, there is only one standard option. It is easy to open with just a few security and identification steps needed before you can go ahead and start trading. If you want to try the platform before depositing funds you have the option to try the demo account first.

Live Account

To open a live account requires a minimum deposit of $200AUD, £100 or $100. It is easy to open. Complete the application process and start trading in over 50 assets. Unlike some brokers, you won't be given the hard sell. You are left to enjoy your trading without constant sales tactics to try and get you to spend more. A substantial benefit of trading with Plus500 is that your account is protected by negative balance protection so you will never lose more than you deposit.

Demo Account

Whether you are a new trader or have previous CFD experience, it never hurts to take advantage of the demo platform. Before you sign up for a live account, you can use the demo site without having to deposit any funds. This allows you to become familiar with the platform, the assets, the spreads and to get a feel for trading with virtual funds before you risk your own money.

Making mistakes on a demo version of the site means that you stand more chance of success on the live platform.

Trade Features And Payouts

While Plus500 makes it easy to open an account, do they offer the trade features and payouts that you are looking for? Some of the critical considerations for traders include the payouts, commissions, spreads and leverage offered. How many assets do they provide and are tools such as stop/loss orders available? We take a look at the various trading features to equip you with the knowledge you need:

Leverage

Leverage can vary hugely between CFD brokers. With Plus500, the maximum leverage available for retail accounts is 1:30. This means that you can never "borrow" more than 30 times what you are trading. While you may see the figure 1:300 displayed, it should be noted that this is for professional accounts, not retail. While this can increase the size of your winnings dramatically, it should be noted that it can also increase the amount you lose.

Spreads

There are no commissions charged by Plus500; they make their money from the spreads that they offer. As an example, if you were to trade the gold, the bid price would be 1.3128, and the sell rate would be 1.3126. This gives a market spread of 2 pips. Fundamentally, for you, it means that you don't pay the commissions, the market spread covers it. Their spreads are dynamic and competitive with other brokers in the market.

Stop Loss

The stop loss is a crucial feature of CFD trading which allows you to minimise the risk of your losses. If you want to exit a trade when you start to lose then you set up a stop-loss order to quit the trade at a pre-determined price. In addition to this, the broker offers a close at a profit (limit), this also needs to be set up before you enter the trade but means when that price is reached, the trade will be exited, and you get to take the profit.

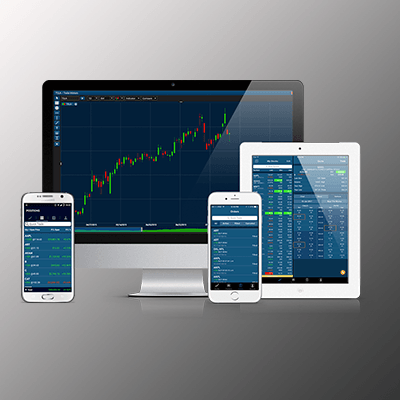

Platform Types

There are several trading applications offered by the broker to enhance your CFD experience. The Plus500 Webtrader platform is web-based and can be used on Chrome, Internet Explorer and Firefox. There is also a trading platform for most iOS, Android and Windows mobile devices and Windows trader which is software that can be run on Microsoft Windows. This gives you the flexibility to trade on the move.

Bonuses And Promotions

While many CFD brokers will offer welcome bonuses to entice you to open an account with them, there is no mention of any bonuses or promotions on their website. There is also no sign of any promotional offers, including trading competitions.

With a low minimum deposit requirement, it is easy to open an account and the fact that they offer a free demo account also gives them that extra value to new traders who want to try their services.

Mobile Trading

Trading with Plus500 from a mobile device is simple. With a trading app available for download on iOS, Android and Windows, the experience is very much tailored for those who want to trade on the move. The app is continually updated based on user feedback and is available in 36 different languages.

The user experience is consistent with that offered on the web-based, or download version offered on desktop.

While heavily regulated and with no reason to doubt this well-reputed broker.

Deposits And Withdrawals

Making a deposit is straightforward, and money can be deposited in your account using several methods. The broker accepts major credit or debit cards and e-wallets such as Skrill or Paypal. Bank transfer is also accepted. The broker does not charge for withdrawals although it should be noted that a fee from your bank or payment provider may be made along with currency conversion charges.

There is some small print that states that a charge may be incurred if the maximum amount of monthly withdrawals is exceeded. It should also be noticed that a significant of $10 will several after a period of inactivity.

Special Features

Many features make Plus500 the right choice. Their demo account, which doesn't come with any time limits, is just one of them. In addition to this there are no commissions as the cost of trading is covered by the spreads.

The fact that you can easily interchange between a choice of over 30 languages is also a great feature alongside the fact that the broker is listed on the London Stock Exchange. Your account is also covered by negative balance protection should you lose all of your funds using leverage.

Customer Support

Customer support is available in the form of live chat 24 hours a day, 7 days a week on both desktop and mobile. It sits in the bottom right-hand corner of the site and enlarges if you are moving around the site for some time.

Apart from this there doesn't seem to be any other way to contact the broker. There are no listed phone numbers or email support addresses. You can, however, follow them on the major social media platforms including Facebook and Twitter.

We want to help our readers in any way we can, but sometimes it's better to talk directly with your investing site to get the answers you need. For example if you have a specific query about your account you'll need to contact them in person due to security.

Alternatively, if you find that contacting your investing partner isn't working, you can contact us and we will be more than happy to try on your behalf. We have excellent working relationships with many of the sites we list and recommend.

Plus500

-

Email:

[email protected]

Email:

[email protected]

-

Phone:

+44 0203 876 1641

Phone:

+44 0203 876 1641

-

Address:

Plus500 UK Ltd, 78 Cornhill, London, EC3V 3QQ, UK

Address:

Plus500 UK Ltd, 78 Cornhill, London, EC3V 3QQ, UK

Conclusion

If you want a broker that you can trust then the fact that Plus500 is so heavily regulated by the world's most recognised regulatory bodies and listed on the LSE should instil confidence. Trading is accessible from a variety of devices making trading on the move as accessible as trading from a desktop.

The spreads are competitive, the leverage is excellent and the overall user experience is intuitive and straightforward. If you want to trade in over 50 assets then we think that this broker is the right choice.

Frequently Asked Questions

-

Is Plus500 legit, will they scam me?

-

With licensing and regulation from the world's most recognisable trading bodies, we believe Plus500 to be a reliable, safe choice for you to trade CFDs with.

-

Do they have a decent mobile or tablet app?

-

Whether you are using an iOS, Android or Windows phone or tablet, you will find that you can either trade from an app or on the mobile web-based site.

-

What bonus do they offer for new traders?

-

There are no advertised bonuses or promotions of any description listed on the Plus500 website, but the deposit requirement is low.

-

Can I start trading on a free demo account?

-

If you want to "try before you buy", there is a free demo account that anyone can use with the added benefit that you don't need to use it within a fixed period.

-

What's the min. deposit and ideal trade amount?

-

The minimum deposit required to open an account is just $100, £100 or $200AUD. Choose how much you trade, and if you wish to use leverage to increase this.

Top Rated CFD Site

#1 - Pocket Option: Best Overall

Risk Warning: The products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad Disclosure: Some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Charles has worked at brokers since he finished his studies at university. Starting as a Junior Trading assistant and progressing into a Business Development we’re delighted that he’s been part of the team since 2015.

Website Reviews

Website Reviews

Mobile Apps

Mobile Apps

Trading Robots

Trading Robots